Always be the first to know. Get notified when new reports are published.

Key Insights At National Level

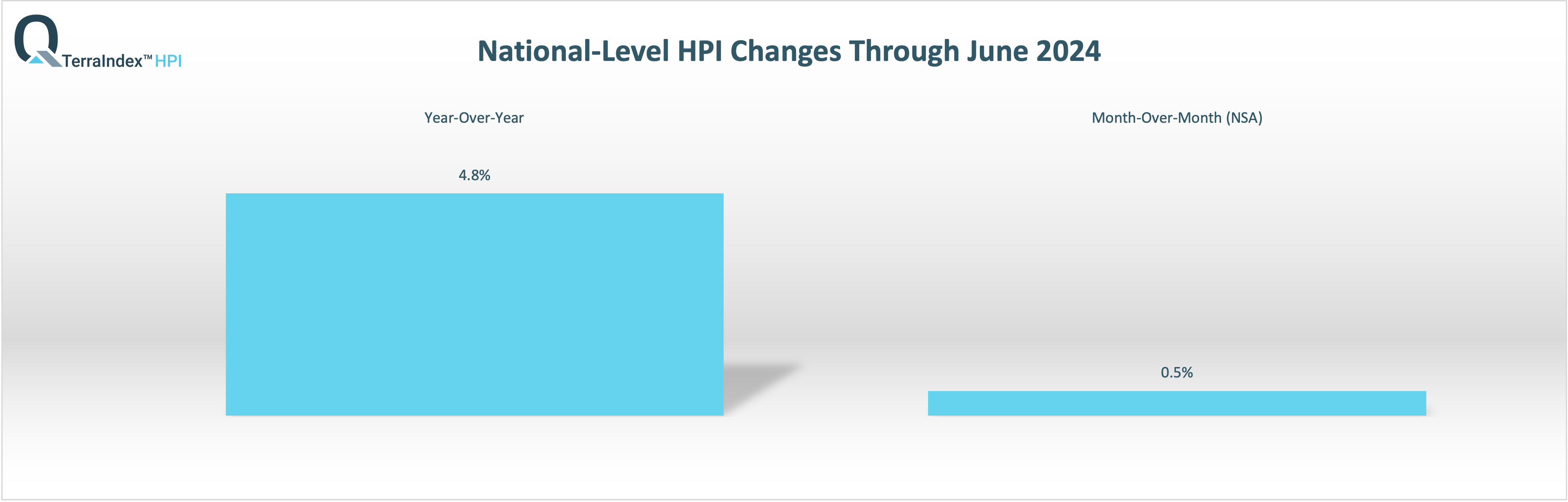

U.S. home values for combined single-family detached and single-family attached properties increased by 4.8% in June 2024 from the same month last year, continuing its deceleration that started a couple of months ago.

On a month-over-month basis, non-seasonally adjusted (NSA) home values increased by just 0.5% in June 2024, well below historical averages for this month. Seasonally adjusted home values were basically flat for the second month in a row.

Home price growth is stalling, catching up to market realities, namely high interest rates and record prices. Given the current trends, home values for the second half of 2024 could follow a downward trajectory similar to 2022 if interest rates remain high.

Key Insights At State Level

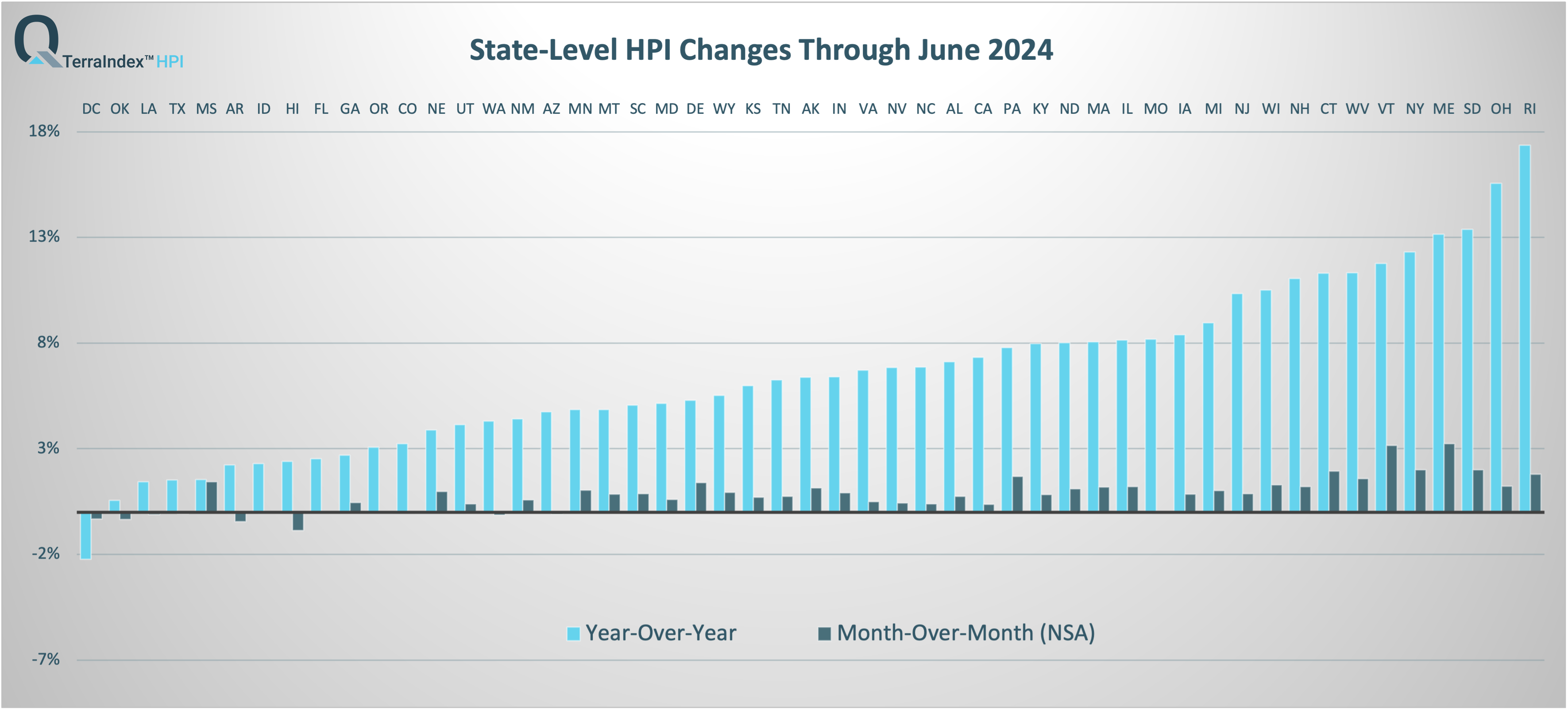

On a year-over-year basis, only the District of Columbia remains in negative territory through the end of June 2024. Rhode Island and Ohio continue to register the strongest annual home value growth.

On a month-over-month basis, there are now 13 states where non-seasonally adjusted home value growth stalled in June 2024. Vermont and Maine continue to show the strong home value appreciation.

On a non-seasonally adjusted basis, the median month-over-month home value change among all states was around +0.8% in June 2024, less than half of what it was just two months ago.

Top 50 CBSA Markets

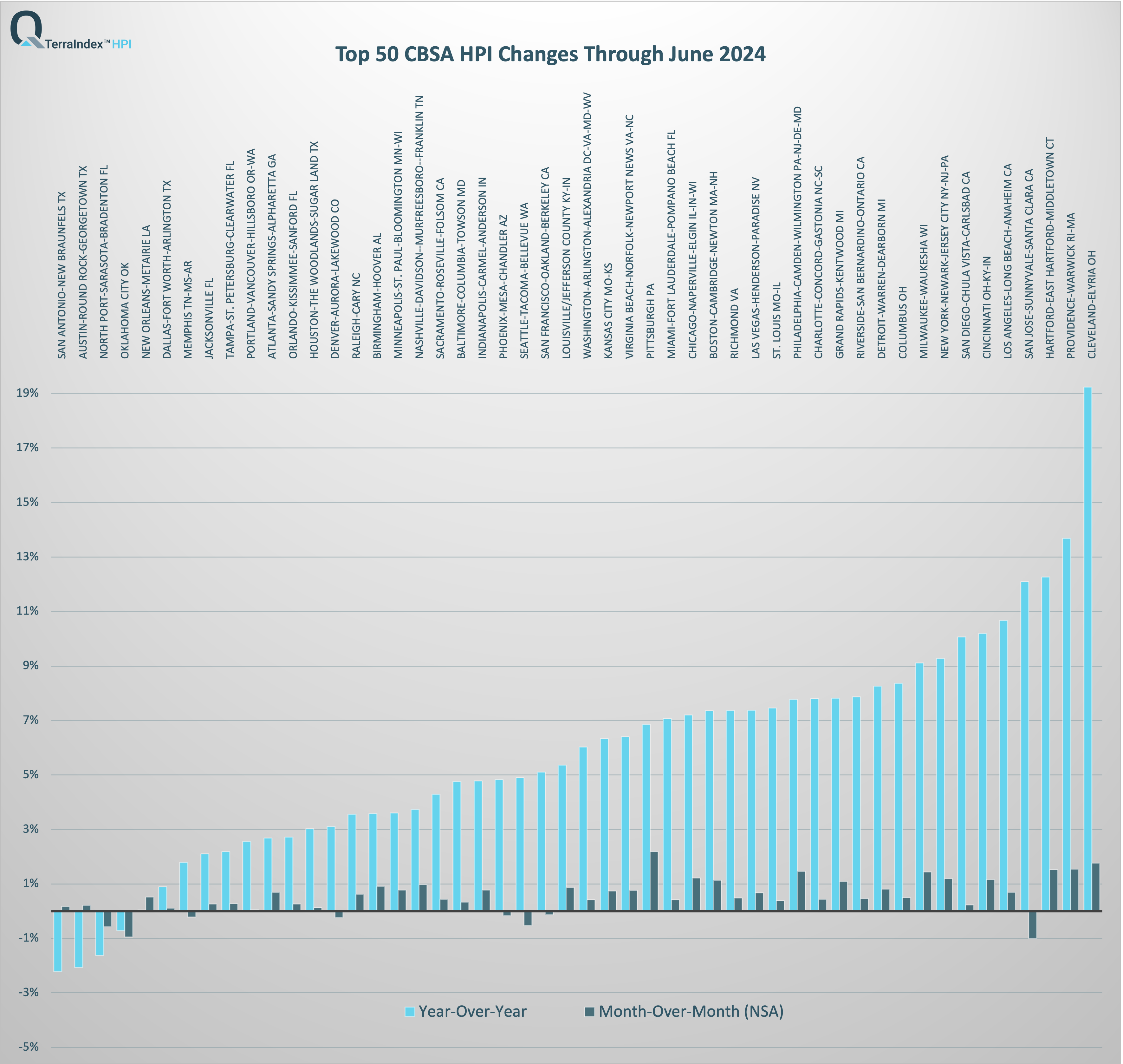

On a year-over-year basis, Austin (TX), San Antonio (TX), North Port-Sarasota (FL) and Oklahoma City (OK) are the only markets with home value depreciation out of the top 50 CBSA markets. Cleveland (OH) continues to stand apart with the strongest annual home value growth.

On a month-over-month basis, eight of the top 50 CBSA markets show non-seasonally adjusted home value depreciation, led by San Jose (CA) and Oklahoma City (OK). Pittsburgh (PA) and Cleveland (OH) registered the strongest monthly home values appreciation in June.

Home value growth appears to be slowing down significantly in most markets as we entered the summer buying season, which is atypical for this time of the year. It seems that persistently high interest rates, record prices, and increasing inventories will put pressure on home prices for the rest of the year.

Why TerraIndex™ HPI

Our Home Price Index (HPI) is based on the proprietary Quantarium Valuation Model (QVM) value estimates for more than 100 million residential U.S. homes. QVM has been tested extensively in the last 5 years by some of the top third-party AVM testing agencies in the U.S. and has been consistently ranked at the top for both Accuracy and Hit Rate performance metrics. QVM was also recently approved by Fitch Ratings for Wall Street transactions. You can read the announcement here.

QVM re-computes the estimated values for the entire national footprint on a weekly basis, along with HPIs at various geography levels – from State, County, CBSA, down to Zip Code and Census Tract. Furthermore, the HPIs produced on any given date are based on proprietary valuation models which include over 90% of all sales transactions that will have been eventually reported through a four-week rolling period ending that date, taking advantage of Quantarium’s industry leading Data Services Platform (QDSP) to reduce the processing time lag to an absolute minimum. That allows Quantarium to provide the most current market insights, weeks faster than most other housing indices in the U.S. Learn more about TerraIndex™ HPI here.

The report for a given month is usually available on the second Wednesday of the following month, for example HPIs for the month of December 2022 were made available on Wednesday, January 11, 2023.

About Quantarium

Located in Bellevue, WA, Quantarium was founded by a team of leading scientists and Ph.D.’s. The company has designed and developed an innovative and enabling set of AI and Visual Technologies currently being deployed across multiple real estate industry sectors. Quantarium is one of the most accurate sources of property insights for over 158 million U.S. properties and trusted by major mortgage lenders, financial institutes, builders, direct marketing agencies, and real estate professionals across the nation. With a technology suite that is different in kind, then degree, the company’s products and services uncover and capitalize on the core DNA of vertical industries. From genetic modeling property valuations and markets that understand and interpret real estate data as expressed through synthetic future populations, through to CV adjusted values, Quantarium offers real AI to drive real value.

For business inquiries, please contact us at 424.210.8847 or discover@quantarium.com.