Key Insights At National Level

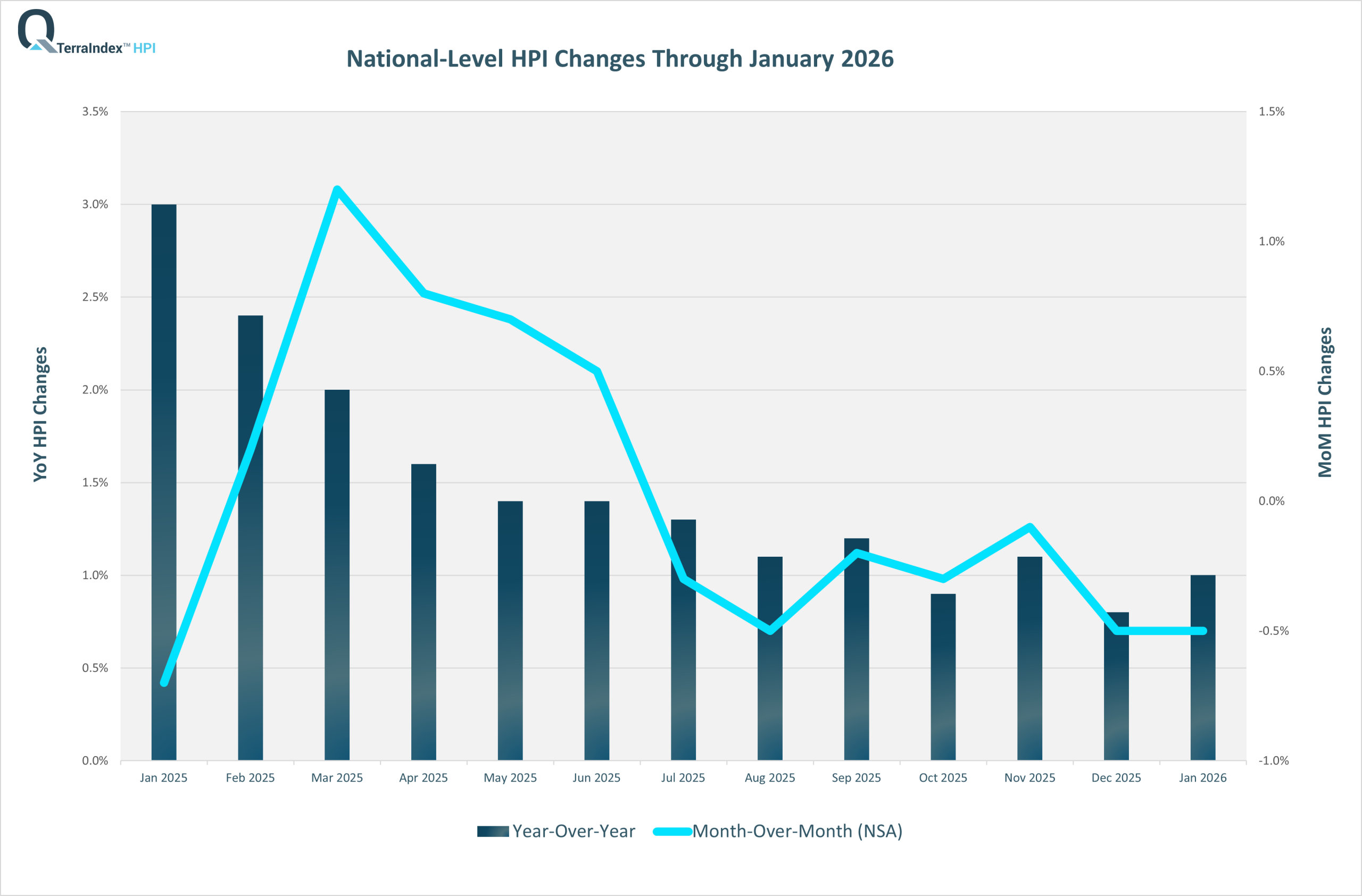

U.S. home values for combined single-family detached and single-family attached properties rose 1% year-over-year, a slight improvement from last month’s annual growth reading.

On a month-over-month basis, non-seasonally adjusted (NSA) home values decreased by 0.5% in January 2026. On a seasonally adjusted basis, home values declined by 0.1%.

Nationwide, home values entered 2026 with similar trends as the end of 2025. The market continues to face challenges, despite slightly improved affordability compared with the beginning of last year.

Key Insights At State Level

On a year-over-year basis, the District of Columbia, Florida, Texas, Colorado, and Arizona recorded the largest declines of around -3% through the end of January 2026. Delaware posted the strongest annual growth.

On a month-over-month basis, 90% of U.S. states experienced home value depreciation in January 2026. West Virginia, Wyoming, and Rhode Island were among the few states that saw meaningful monthly growth.

On a non-seasonally adjusted basis, the median month-over-month change in home values was approximately -0.6% in January 2026, a slight decrease from -0.5% in the prior month.

Top 50 CBSA Markets

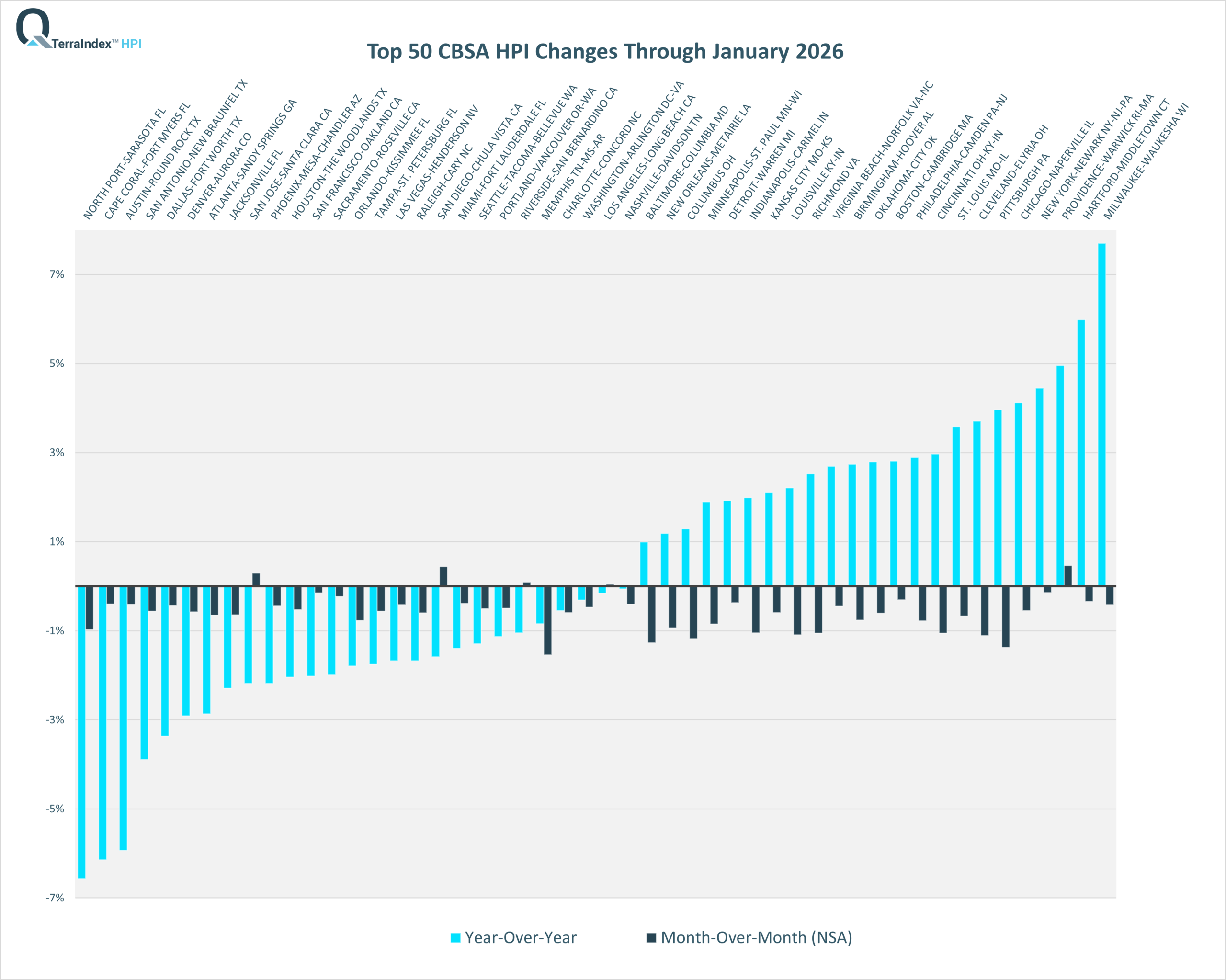

On a year-over-year basis, 54% of the top 50 CBSA markets remained in negative territory through January 2026. North Port – Sarasota (FL), Cape Coral (FL), and Austin (TX) posted the largest annual declines, around -6%. Milwaukee (WI) stood out with the strongest annual home value growth, exceeding 7%.

On a month-over-month basis, about 90% of the top 50 CBSA markets experienced home value declines on a non-seasonally adjusted basis. Providence (MA), San Diego (CA), and San Jose (CA) were the only top 50 CBSA markets to show meaningful monthly growth in January 2026.

On a non-seasonally adjusted basis, the median month-over-month home value change among the top 50 markets was around -0.5%, same as last month. While depreciation still prevails in most markets, the negative trend is receding and may be nearing a turning point as the Spring season approaches.

Why TerraIndex™ HPI

Our Home Price Index (HPI) is based on the proprietary Quantarium Valuation Model (QVM) value estimates for more than 100 million residential U.S. homes. QVM has been tested extensively in the last 5 years by some of the top third-party AVM testing agencies in the U.S. and has been consistently ranked at the top for both Accuracy and Hit Rate performance metrics. QVM was also recently approved by Fitch Ratings for Wall Street transactions. You can read the announcement here.

QVM re-computes the estimated values for the entire national footprint on a weekly basis, along with HPIs at various geography levels – from State, County, CBSA, down to Zip Code and Census Tract. Furthermore, the HPIs produced on any given date are based on proprietary valuation models which include over 90% of all sales transactions that will have been eventually reported through a four-week rolling period ending that date, taking advantage of Quantarium’s industry leading Data Services Platform (QDSP) to reduce the processing time lag to an absolute minimum. That allows Quantarium to provide the most current market insights, weeks faster than most other housing indices in the U.S. Learn more about TerraIndex™ HPI here.

The report for a given month is usually available on the second Wednesday of the following month, for example HPIs for the month of December 2022 were made available on Wednesday, January 11, 2023.

About Quantarium

Located in Bellevue, WA, Quantarium was founded by a team of leading scientists and Ph.D.’s. The company has designed and developed an innovative and enabling set of AI and Visual Technologies currently being deployed across multiple real estate industry sectors. Quantarium is one of the most accurate sources of property insights for over 158 million U.S. properties and trusted by major mortgage lenders, financial institutes, builders, direct marketing agencies, and real estate professionals across the nation. With a technology suite that is different in kind, then degree, the company’s products and services uncover and capitalize on the core DNA of vertical industries. From genetic modeling property valuations and markets that understand and interpret real estate data as expressed through synthetic future populations, through to CV adjusted values, Quantarium offers real AI to drive real value.

For business inquiries, please contact us at 424.210.8847 or discover@quantarium.com.